Industries

Explore the latest news and updates from the community

Explore the latest news and updates from the community

In the fast-paced and ever-evolving world of business, the need for strategic financial leadership has become increasingly critical. However, for many small to medium-sized enterprises, the cost of hiring a full-time Chief Financial Officer (CFO) can be prohibitive. This is where the concept of "fractional CFO" services has emerged as a game-changer.

A fractional CFO is a seasoned financial professional who provides CFO-level expertise and services to businesses on a part-time or as-needed basis. Unlike a traditional full-time CFO, a fractional CFO is not a permanent employee of the company but rather a highly skilled consultant who can be engaged for specific projects or ongoing financial management.

The "fractional" aspect refers to the flexible and scalable nature of these services, allowing businesses to access the financial acumen they need without the commitment and cost of a full-time executive-level role.

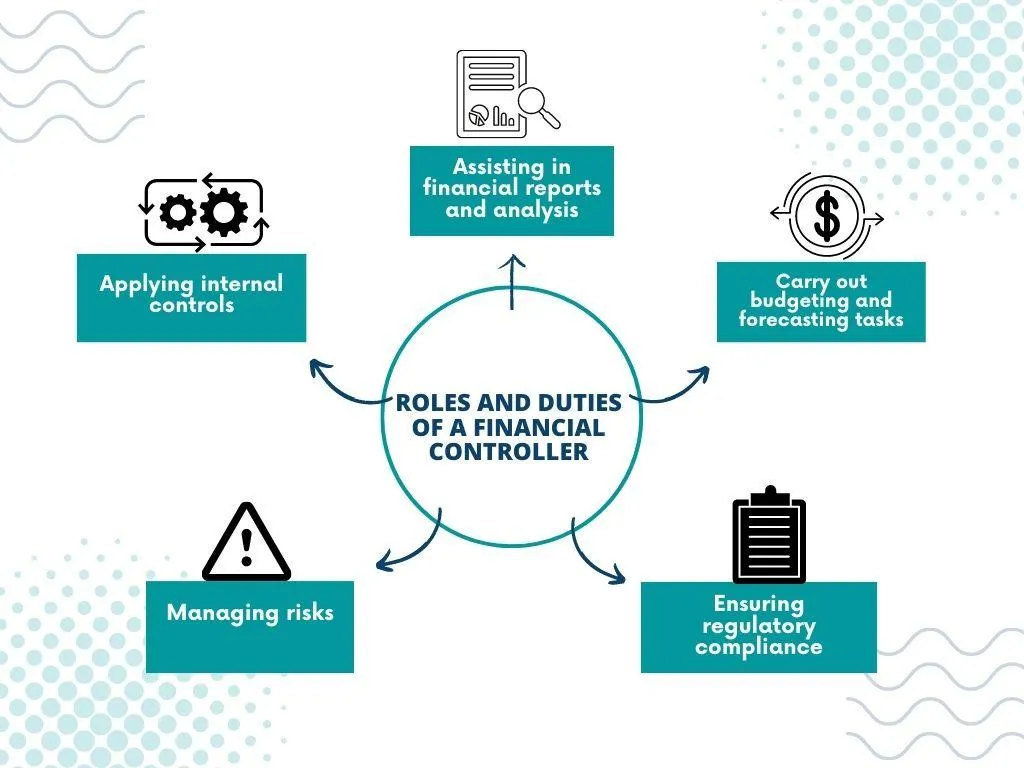

Fractional CFOs can provide a wide range of financial services to businesses, including:

Businesses may benefit from a fractional CFO in various situations, such as:

Fractional CFO services are typically offered through specialized firms or independent consultants. These providers often use a variety of engagement models, such as hourly, retainer-based, or project-specific arrangements, to best suit the needs of their clients.

Fractional CFOs integrate with a business's existing financial team, leveraging technology and collaboration tools to work remotely and provide their services efficiently. This approach allows for seamless integration and the ability to scale services as the business's requirements evolve.

Fractional CFOs typically have extensive experience in senior financial roles, such as CFO, controller, or financial analyst. Many possess advanced degrees, certifications, and specialized industry knowledge that enable them to provide high-level financial expertise.

When selecting a fractional CFO, businesses should consider factors such as the provider's background, industry specialization, and track record of successful engagements.

Many businesses have benefited from the services of fractional CFOs. For example, a growing e-commerce startup was able to streamline its financial processes, improve cash flow management, and secure a successful funding round with the assistance of a fractional CFO. Similarly, a small manufacturing company was able to navigate a complex merger and acquisition with the guidance of a fractional CFO, ensuring a smooth transition and financial stability.

As businesses continue to face evolving financial challenges and the need for specialized expertise, the demand for fractional CFO services is expected to grow. Technological advancements, such as cloud-based accounting software and virtual collaboration tools, will further enhance the accessibility and effectiveness of these services.

In today's dynamic business landscape, the concept of fractional CFO services offers a strategic and cost-effective solution for companies seeking to optimize their financial management and decision-making processes. By tapping into the expertise of seasoned financial professionals, businesses can unlock the financial insights and guidance needed to thrive in an increasingly complex and competitive environment.